The 45-Second Trick For Estate Planning Attorney

The 45-Second Trick For Estate Planning Attorney

Blog Article

5 Simple Techniques For Estate Planning Attorney

Table of ContentsEstate Planning Attorney - The FactsEstate Planning Attorney Can Be Fun For AnyoneThe 4-Minute Rule for Estate Planning AttorneyRumored Buzz on Estate Planning AttorneyThe Estate Planning Attorney Statements

A skilled lawyer who comprehends all aspects of estate planning can help make certain clients' wishes are carried out according to their intents. With the right guidance from a trustworthy estate coordinator, individuals can really feel confident that their plan has actually been developed with due treatment and attention to information. Therefore, people require to spend adequate time in finding the ideal lawyer who can provide audio recommendations throughout the whole procedure of developing an estate strategy.The documents and directions created throughout the planning procedure come to be legally binding upon the client's death. A certified monetary advisor, based on the dreams of the dead, will certainly after that start to disperse count on properties according to the client's instructions. It is crucial to note that for an estate strategy to be effective, it needs to be correctly implemented after the customer's fatality.

The appointed executor or trustee need to guarantee that all possessions are taken care of according to legal demands and based on the deceased's desires. This usually includes gathering all documentation pertaining to accounts, investments, tax obligation documents, and various other items specified by the estate strategy. Furthermore, the executor or trustee may require to coordinate with financial institutions and recipients included in the circulation of possessions and various other issues relating to clearing up the estate.

In such situations, it may be necessary for a court to interfere and resolve any conflicts before last distributions are made from an estate. Ultimately, all aspects of an estate have to be worked out efficiently and accurately in conformity with existing legislations so that all parties entailed get their fair share as planned by their liked one's wishes.

The Estate Planning Attorney Statements

Individuals need to plainly comprehend all facets of their estate plan before it is instated (Estate Planning Attorney). Working with a skilled estate preparation attorney can help make certain the files are appropriately drafted, and all assumptions are satisfied. Furthermore, a lawyer can provide understanding right into how various legal devices can be utilized to safeguard properties and optimize the transfer of wealth from one generation to one more

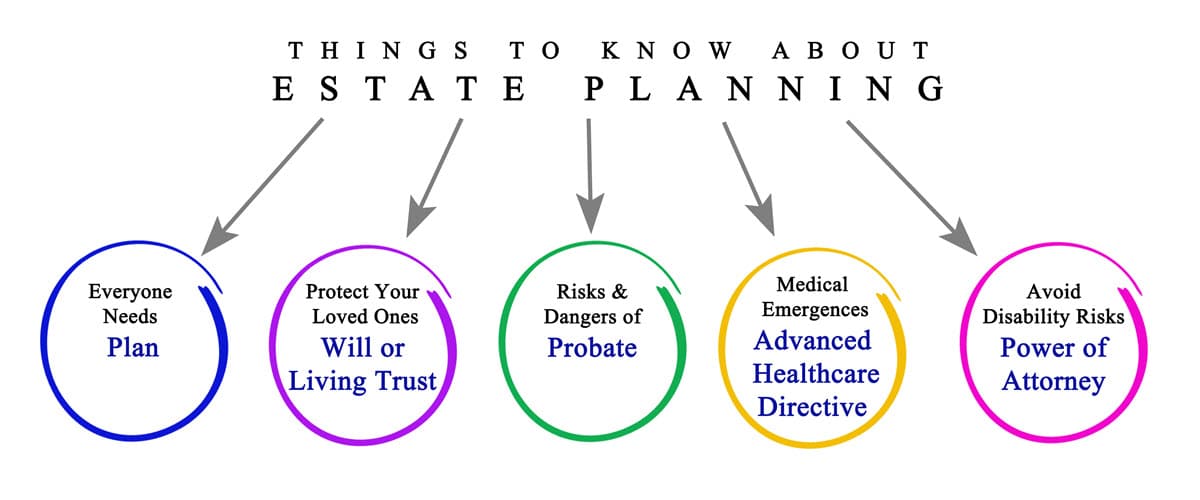

Estate intending describes the prep work of tasks that manage an individual's financial circumstance in the event of their incapacitation or death - Estate Planning Attorney. This preparation consists of the legacy of assets to successors and the settlement of estate taxes and debts, along with other considerations like the guardianship of minor youngsters and family pets

Several of the actions include providing assets and debts, assessing accounts, and composing a will. Estate planning tasks Visit Website consist of making a will, establishing up depends on, making charitable donations to limit inheritance tax, calling an administrator and recipients, and establishing up funeral arrangements. A will certainly gives instructions concerning residential or commercial property and custodianship of minor kids.

Some Known Facts About Estate Planning Attorney.

Estate preparation can and ought to be made use of by everyonenot simply the ultra-wealthy. Estate planning entails determining just how an individual's assets will certainly be maintained, managed, and distributed after fatality. It also takes right into account the monitoring of an individual's homes and financial responsibilities on the occasion that they come to be incapacitated. Possessions that can compose an estate include houses, lorries, stocks, art, antiques, life insurance policy (Estate Planning Attorney), pension plans, debt, and much more.

Anyone canand shouldconsider estate planning. There are different reasons that you might begin estate planning, such as protecting family members wealth, offering an you could look here enduring spouse and children, moneying kids's or grandchildren's education, and leaving your tradition for a philanthropic cause. Composing a will is one of the most essential steps.

Evaluation your retired life accounts. This is vital, particularly for accounts that have beneficiaries affixed to them. Keep in mind, any type of accounts with a recipient pass straight to them. 5. Evaluation your insurance coverage and annuities. See to it your beneficiary info is up-to-date and all of your other details is precise. 6. Set up joint accounts or transfer of death designations.

The Greatest Guide To Estate Planning Attorney

8. Compose your will. Wills do not simply untangle any type of economic uncertainty, they can likewise outline strategies for your minor children and animals, and you can likewise instruct your estate to make charitable donations with the funds address you leave. 9. Testimonial your documents. Make certain you look into whatever every number of years and make changes whenever you please.

Send a copy of your will certainly to your manager. This makes sure there is no second-guessing that a will certainly exists or that it gets lost. Send one to the person that will certainly presume obligation for your affairs after you die and keep one more copy somewhere safe. 11. See a financial specialist.

Not known Facts About Estate Planning Attorney

There are tax-advantaged financial investment vehicles you can benefit from to aid you and others, such as 529 college financial savings prepares for your grandchildren. A will is a legal record that offers guidelines about exactly how a person's residential property and guardianship of small youngsters (if any) must be dealt with after death.

Report this page